My Services

Website Development

Custom HTML Sites & WordPress – Business, portfolio, blog, and store websites

Google Services

Analytics, Search Console, Tag Manager – Full setup with tracking and reporting

SEO Optimization

On-page, Technical & Blog SEO – Keyword research, meta tags & sitemap.

Graphic Design

Professional logos, flyers, social media visuals, and invoice designs that strengthen your brand identity.

Blog Setup & Writing

SEO-friendly blog setup and article writing services that attract traffic and keep readers engaged.

Social Media

Set up and integrate business social media accounts seamlessly with your website.

Portfolio

Welcome to Gadget Crunchie, visit Portfolio page to see my completed projects.

Completed Projects

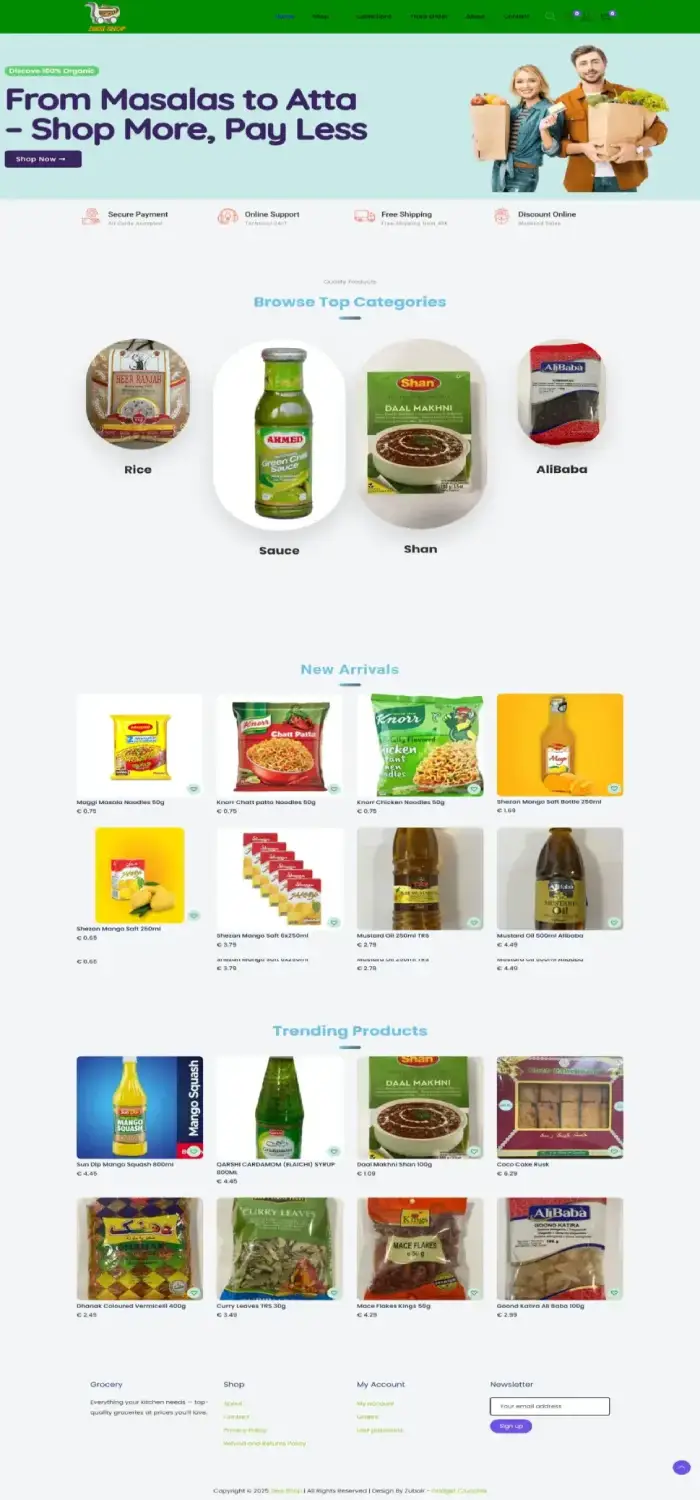

Desi Grocery Store

Germany Grocery Store Website

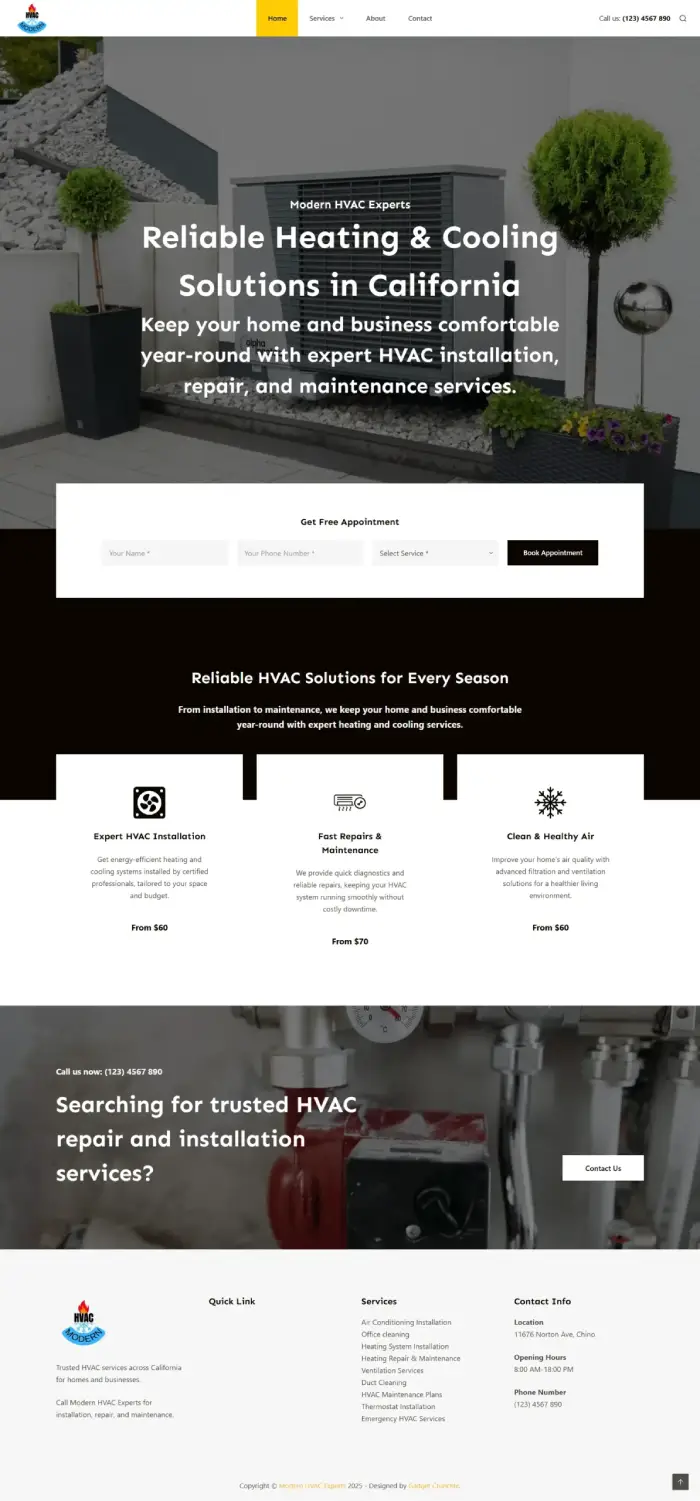

Modern HVAC Experts California USA

American HVAC Website

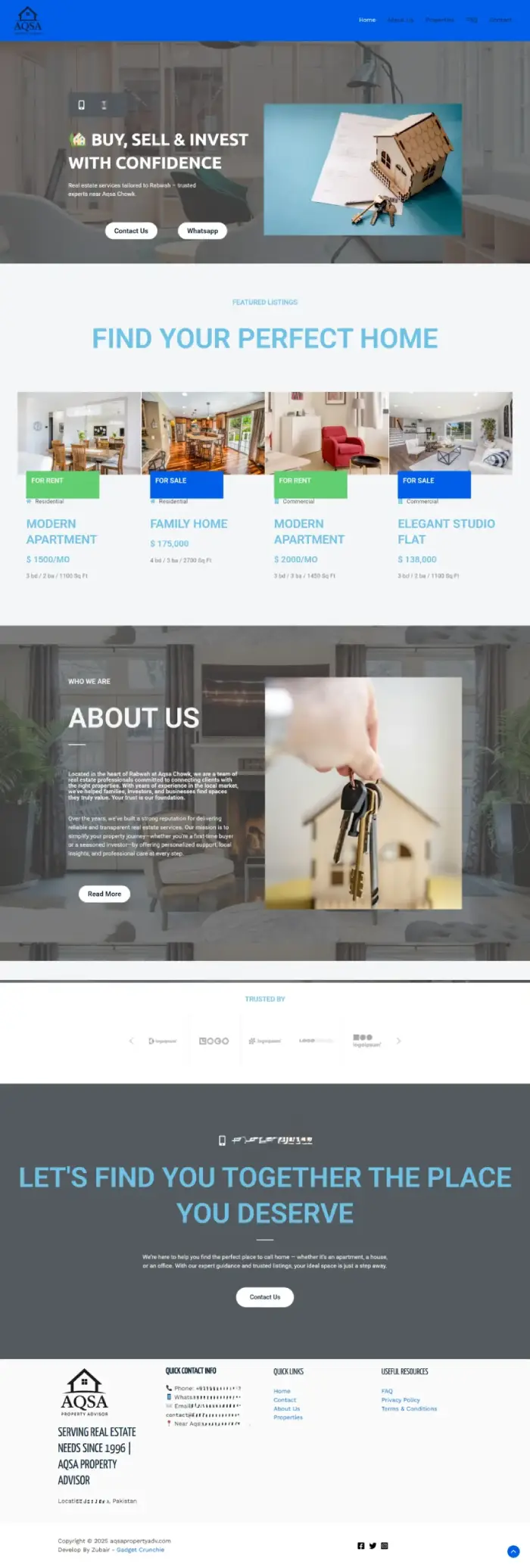

Aqsa Property Adv

Real State Property Website

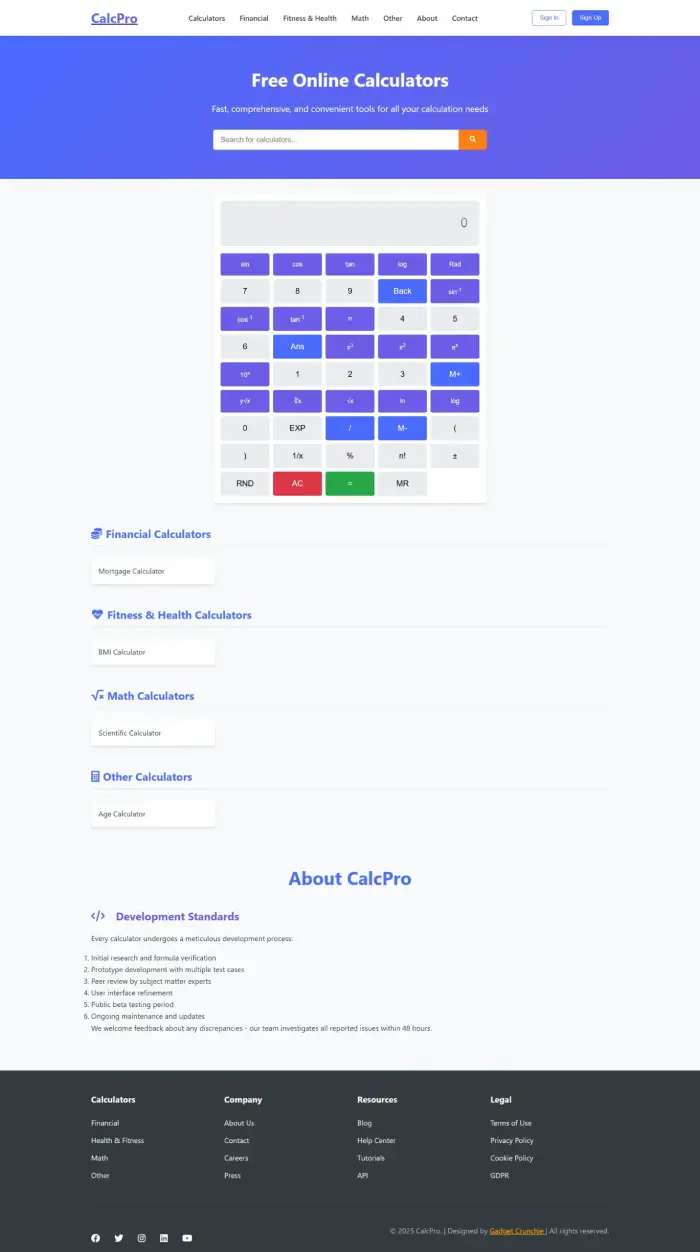

calculators-website

HTML + CSS + Javascript, Clean UI

localhost-VizionSite

Sample site

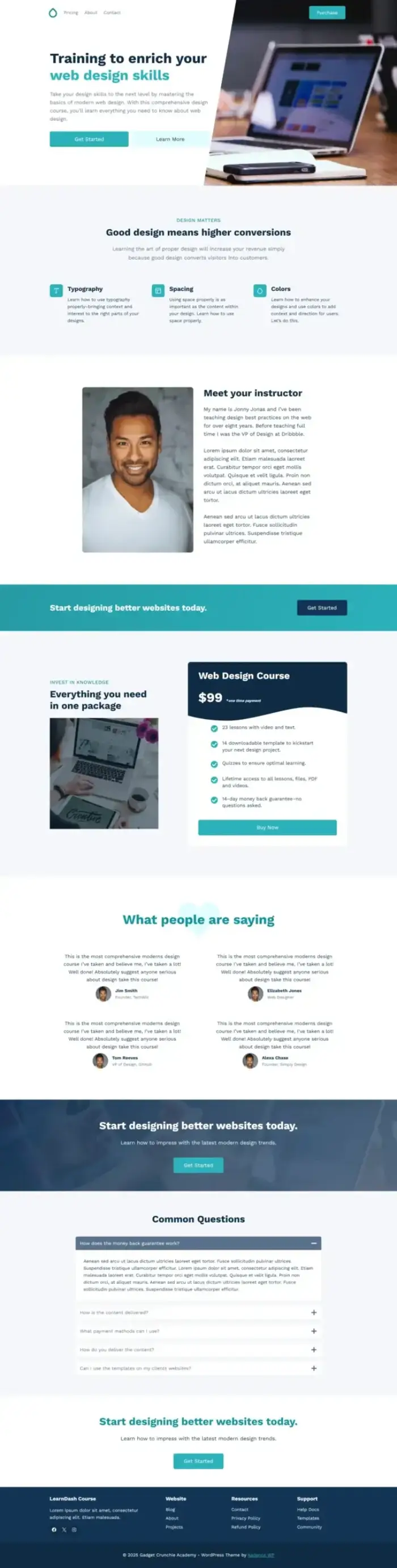

Academy Website

WordPress LMS with blog

visit privacy policy page

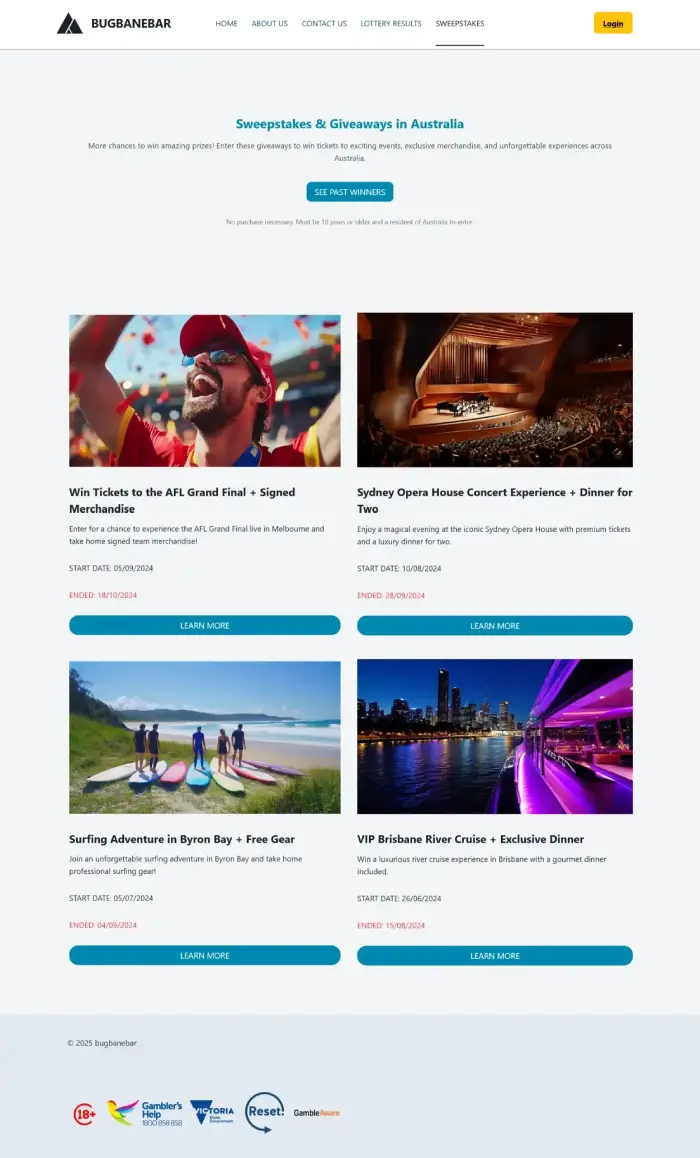

Sweepstakes Site

Lottery entries and blog

Lottery Result Site

HTML + CSS, Clean UI

GMBH CH Site

Germany Site Dutch Language

Vizion Site

Local Host Design

BugbanebarSite

Local Host Design

Popular Blog Posts

From The Archives (Old Posts)

Latest Blog Posts

Testimonials

Gadget Crunchie built a clean and professional WooCommerce store for my gadget business. Sales improved within weeks!

— Ali Raza, Online Gadget Seller

Their blog formatting and Amazon affiliate setup helped me start earning consistently through my content.

— Sarah Paterson, Affiliate Blogger (USA)

Fast-loading site, modern design, and complete Google service setup — all done smoothly.

— Hira Sheikh, Tech Blogger & Reviewer

I was confused between Shopify and WordPress, but they guided me perfectly and delivered a great online store!

— David Lee, Film Maker